Loan application deadline October 15, 2020

The N.C. COVID-19 Rapid Recovery Loan Program launched on March 24, 2020 with an initial allocation of $15 million provided by Golden LEAF. Applications quickly exceeded available funding. Golden LEAF worked with state leaders and the N.C. General Assembly to appropriate funds to support the program.

“To address the ongoing challenges presented by the pandemic and help boost the loan program to as many potential businesses as possible, Golden LEAF worked with lawmakers on House Bill 1105 to modify the loan program,” said Golden LEAF President, Chief Executive Officer Scott T. Hamilton. “We are proud to offer a resource that many of the state’s small businesses and family farms can utilize to help them navigate through this economic crisis.”

Under House Bill 1105, the modifications to the N.C. COVID-19 Rapid Recovery Loan Program include increasing the period of deferred payments from six months to 18 months, lengthening the total term of the loan from 60 months to 120 months to ease burden on businesses; increasing the amount of funding available to each business from $50,000 to $250,000; and changing eligibility of businesses that may use the program from businesses with 100 full time employees to businesses with up to 150 employees. Borrowers already approved may request a loan modification to access the new available terms.

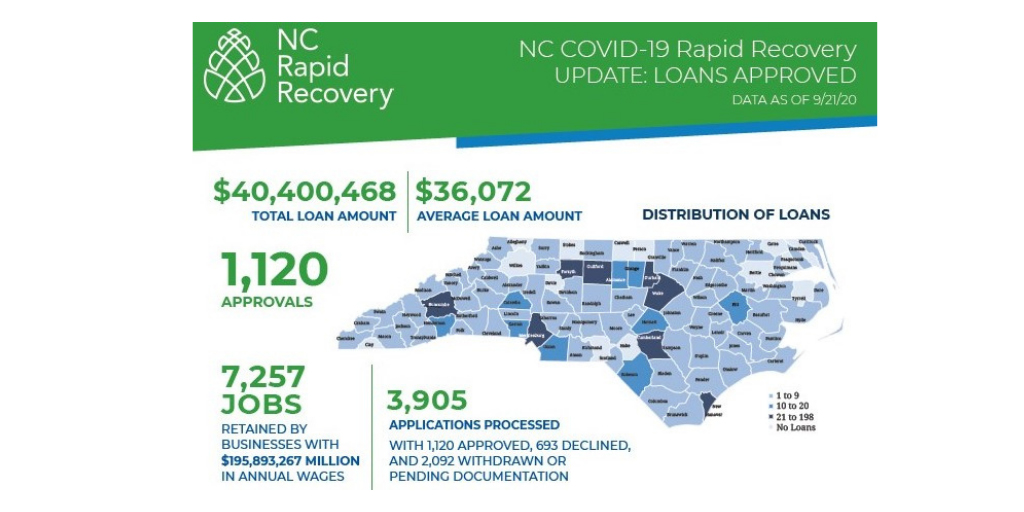

To date, 1,120 loans have been made totaling more than $40 million from all funding sources, including other public and private funding, to support 7,257 jobs. The program has made 64 percent of its loans to minority- and women-owned businesses (Historically Underutilized Businesses).

The N.C. COVID-19 Rapid Recovery Loan Program is driven by a partnership between the Golden LEAF Foundation and the N.C. Rural Center, as well as a consortium of established North Carolina nonprofit lenders, including Business Expansion Funding Corporation (BEFCOR), Carolina Community Impact, Carolina Small Business Development Fund, Mountain BizWorks, Natural Capital Investment Fund, Piedmont Business Capital, and Thread Capital. The Rural Center acts as a program administrator, managing the flow of loan applications to lending partners for underwriting and servicing.

Applications will continue to be processed on a first-come, first-served basis until October 15, 2020. For technical assistance, applicants can send an email [email protected] to be connected with a technical support export. Technical assistance providers include the Institute and the Small Business and Technology Development Center (SBTDC). For more information on the N.C. COVID-19 Rapid Recovery Loan Program and to apply for a loan, visit www.ncrapidrecovery.org.